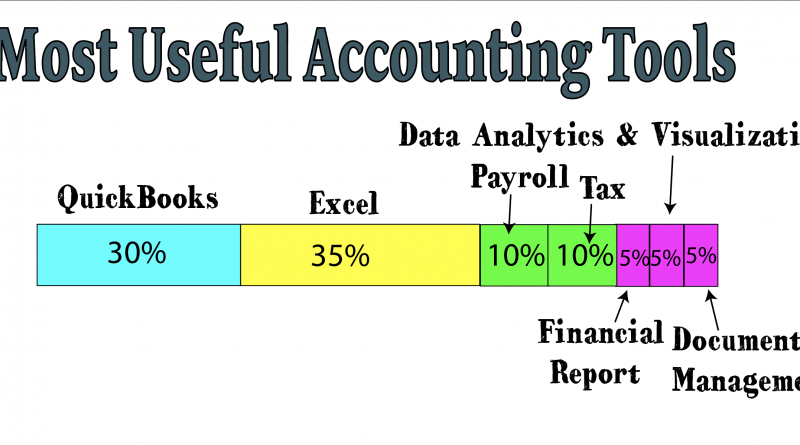

7 Tools Every Accounting Student Should Learn

The following list basically compiles the kind of tools accountants will come across during their careers and during school.

Most of these you’ll have to pick up on your own as they are not introduced in accounting programs.

The first few months of your job will quickly force you to get used to many of these (though possibly not all). However, the more of these you use, the more accurate and efficient your workflow will become. Instead of listing software, I will list the “tools” and give you an example of the one I used personally and alternatives. Some tips will be included as well.

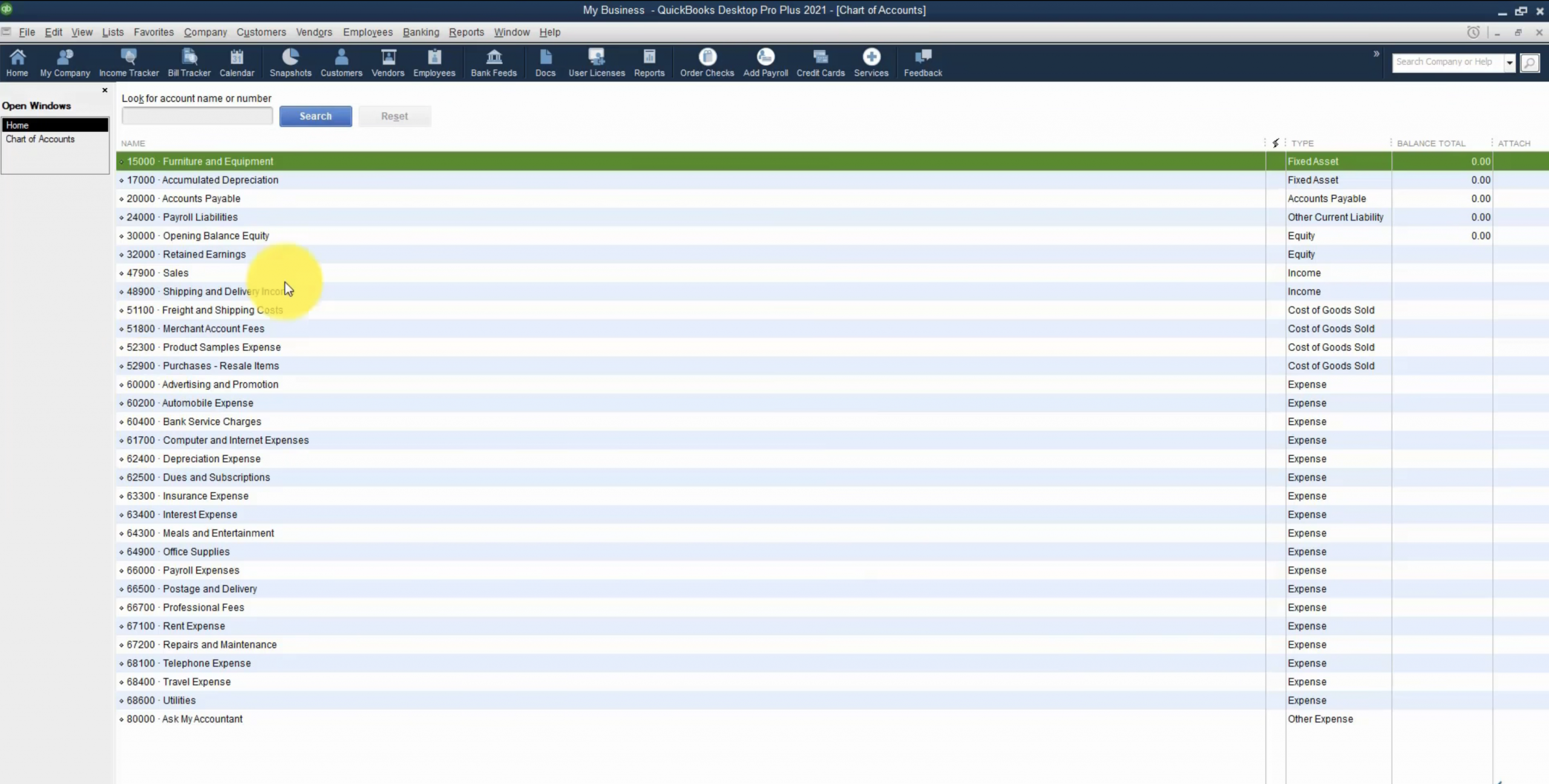

1. Accounting Software: QuickBooks

- Usage: 30%

- How Often: Very Often. QuickBooks will be your go to software for bookkeeping, managing accounts payable and receivable, and tracking income and expenses. You can use quickbooks for for client accounts or internal reports.

- When: Most likely during your internship, you’re not going to use it consistently while in college. If you start early (2nd year it’s good) and slowly (don’t need to do it everyday), by the time you graduate you will gain the necessary skilsl to manage small business accounts.

- Real-World Example: Most common instance is having a small business hire you and have their data (manual bookkeeping) transfered over digital data to organize accounts. Once quickbook’s set up for a business, you can automate their processes: recurring payments, payroll, and tax calculations, making their finances much easier to manage.

- Learning Curve: QuickBooks is user-friendly, especially for basic bookkeeping. However some features, like tax planning and reporting, take quiete a while to learn. Advice here is to play/practice with tax planning and reporting as opposed with bookkeeping because that takes almost no time to learn.

- Alternative Software:

- Xero: A cloud-based . Super popular for small businesses.

- FreshBooks: User-friendly option, particularly for freelancers and small business owners.

- Advice: Get comfortable with accounting software like QuickBooks early. Learning Xero is useful if you want to try cloud-based software.

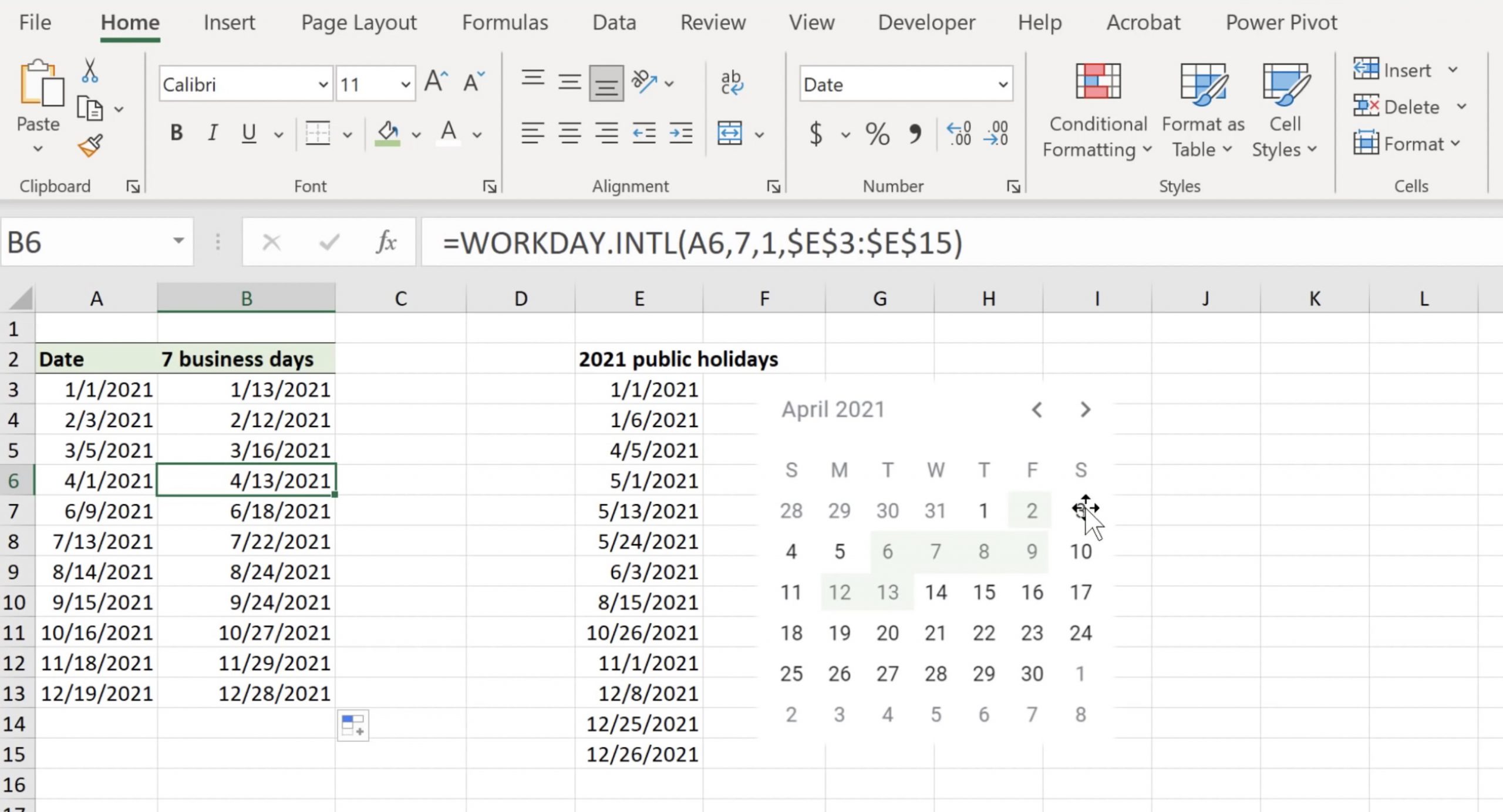

2. Spreadsheet Software: Microsoft Excel

- Usage: 35%

- How Often: Just as often as QuickBooks. From simple calculations and scratch accounting notes to financial models and organizing data for tax planning. It’s going to be a MUST use for ANY type of calculations as well making reports and budgets.

- When: Everybody here was introduced to Excel in High School however it won’t be until your third year in college you will finally be introduced to the most advanced features/macros for pivot tablets and financial modeling.

- Real-World Example: Say you have to make an audit. You will use excel to make detailed financial models and forecasts, combining multiple data sets using complex formulas and functions. The pivot tables will help you summarize large volumes of financial data for easier analysis.

- Learning Curve: Basic Excel functions can take a few days to learn. Using and mastering formulas, pivot tables, and macros takes several weeks. The more advanced features, like data analysis tools and financial modeling, will require consistent practice over a couple of months.

- Alternative Software:

- Google Sheets: A cloud-based spreadsheet alternative , ideal for collaboration.

- Zoho Sheets: Another cloud-based option that integrates with other Zoho products for business management.

- Advice: QuickBooks and Excel will be your best friends as an accountant. If you can master the advanced features like VLOOKUP, pivot tables, and financial modeling EARLY, you will gain an edge in giving clients a more complete business analsys and reporting.

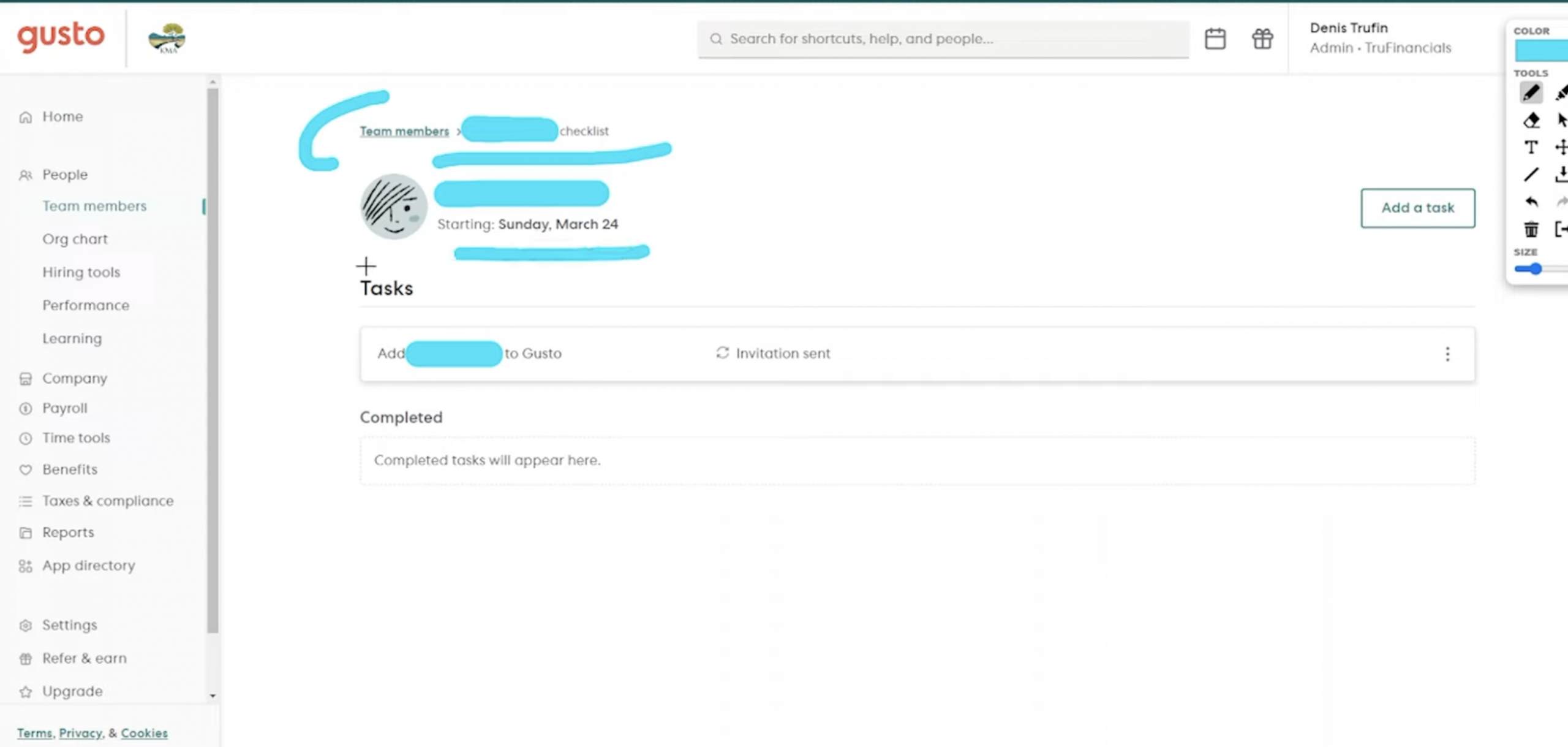

3. Payroll Software: Gusto

- Usage: 10%

- How Often: Gusto is used to manage payroll, benefits, and taxes for clients and businesses. It streamlines the payroll process, ensuring these tasks are done on as well as making sure tax filings are efficiently handled.

- When: You’ll encounter Gusto during your internships. Gusto or a similar software may became part of your daily routine when you start working full time.

- Real-World: Setting up a payroll system for a new startup is the most common way to be introduced to the software. Usually these startups never handled payroll internally. Gusto will let you to automate payments, manage tax withholdings, and even offer employee benefits like health insurance.

- Learning Curve: Gusto is designed to be user-friendly, so even if you’re new to payroll systems, it’s easy to pick up. The challange starts when dealing with payroll laws and tax requirements. Gusto helps guide you through this process too.

- Alternative Software:

- ADP: A widely used payroll platform for businesses of all sizes.

- Paychex: Another payroll service that integrates HR and payroll solutions.

- Advice: If you plan to work with businesses or human resources,you need to learn how to use payroll software like Gusto or ADP. Managing payroll accurately and efficiently is extremely important when working for businesses.

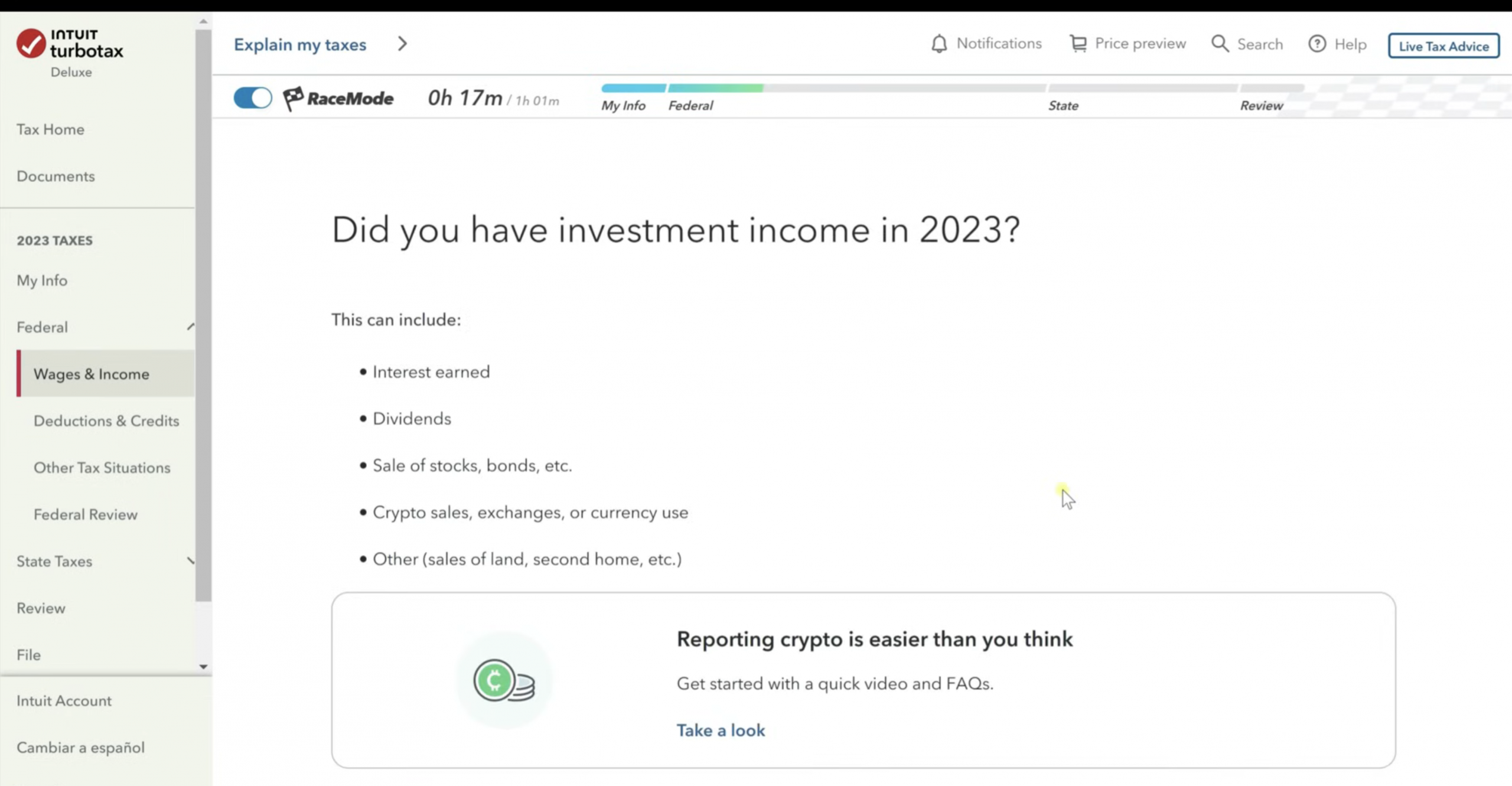

4. Tax Preparation Software: TurboTax & ProSeries

- Usage: 10%

- How Often: I use TurboTax and ProSeries for tax preparation, especially during tax season. These tools streamline the filing process and ensure that clients are compliant with tax laws, while also offering insights into tax deductions and credits.

- When: I started working with tax software in my third year of college during a tax course. It wasn’t until I began preparing taxes professionally that I gained confidence with more complex returns.

- Real-World Example: During tax season, you’ll work with multiple clients with complicated tax situations, including rental properties and investment portfolios. TurboTax & ProSeries not only will let you make tax returns efficiently and with compliance but also make it easy to identify opportunities for tax savings.

- Learning Curve: The learning curve is moderate for TurboTax, but ProSeries and other professional tax software require a deeper understanding of tax codes and regulations.

- Alternative Software:

- H&R Block Tax Software: A good alternative for individual tax returns.

- Drake Tax: A professional tax preparation software designed for CPAs.

- Advice: Start learning tax software early, especially if you will work with lots of small clients. Understanding how to navigate complex tax codes and make use of deductions will make a difference when trying to make an impression on clients.

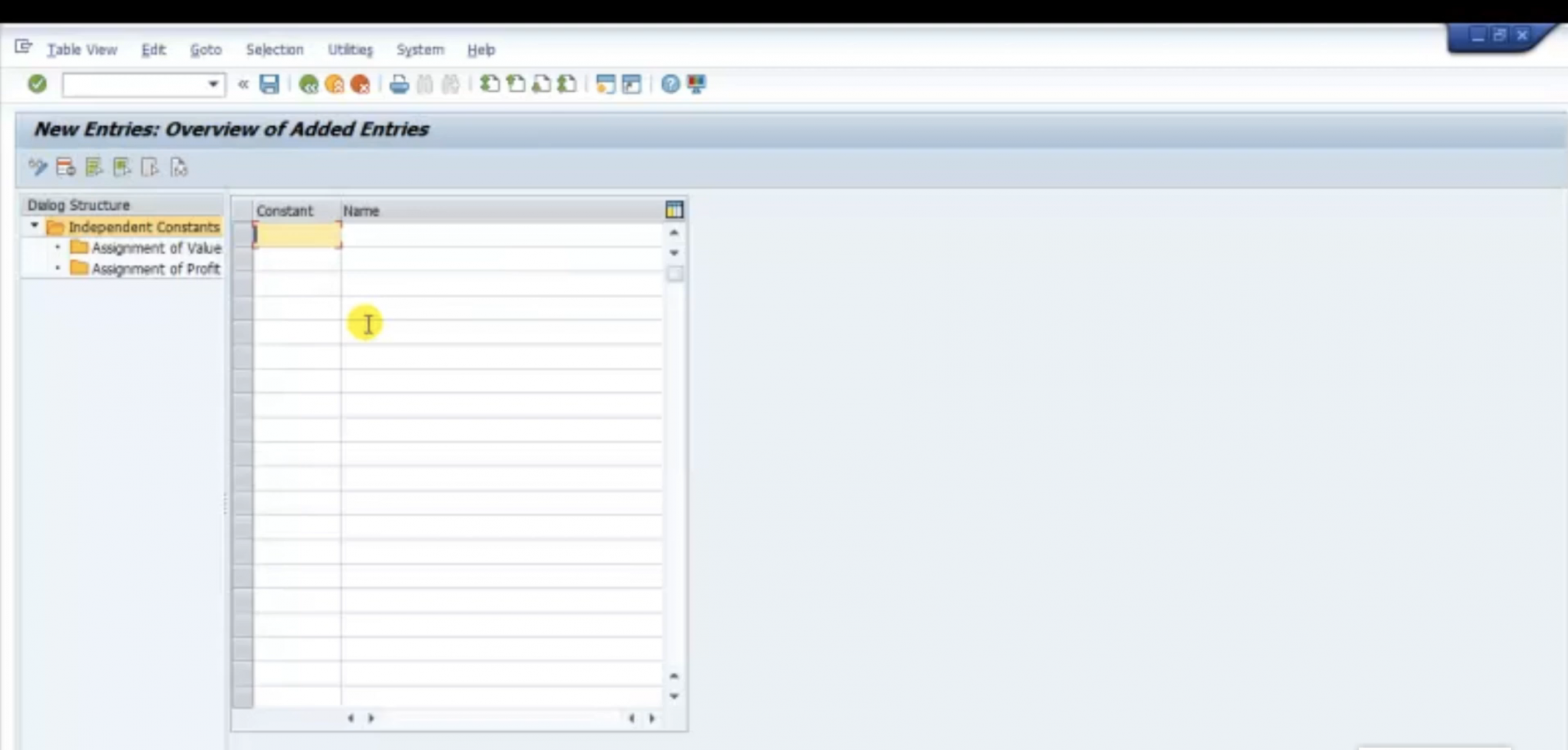

5. Financial Reporting Software: SAP & Oracle NetSuite

- Usage: 5%

- How Often: This is more of an ocassional software and a lot of will probbaly not use it. However, if you work for larger companies, then they becomes necessary.These two give you more complex and complete financial reports whicih includes financial forecasting.

- When: You are likely to be introduced to this software during your 4th year but won’t get to fully use it until you start working for a big corporate company.

- Real-World Example: A large company or a corporate company will always require financial reporting for compliance with regulatory standards. SAP will let you automate the process and make reports for auditors and stakeholders.

- Learning Curve: The learning curve is steep for enterprise systems like SAP and NetSuite due to their complexity. Understanding how to customize financial reports and work with large data sets is key to getting the most out of these tools.

- Alternative Software:

- Microsoft Dynamics 365: An ERP solution that integrates with Microsoft Office tools.

- Sage Intacct: A cloud-based ERP system that focuses on financial management.

- Advice: If you’re aiming for a career in corporate accounting or finance, get familiar with ERP systems like SAP or Oracle. These are the tools you need to master and list down in your resume if you even want to stand a chance at landing those jobs.

6. Document Management & Collaboration: Google Drive & Dropbox

- Usage: 5%

- How Often: Storing & sharing financial documents securely is common practice. GoogleDrive and Dropbox are the easiest options for small businesses and small clients. You can store everything in the cloud such as client records, financial statements, and tax documents, while ensuring that sensitive data is accessible only to those with a password or a link. Though for corporate accounting and large companies it is likely a private cloud service will be used instead.

- Real-World Example: On a audit project, Google Drive will let you organize and share financial documents with the audit team and external auditors. With the sharing permissions feature, you will control who has access to sensitive information.

- Learning Curve: Both tools are easy to use, but the challenge comes in organizing large volumes of documents and ensuring compliance with data security regulations.

- Alternative Software:

- OneDrive: Microsoft’s cloud storage solution, integrated with Office 365.

- Box: A secure cloud storage platform with a focus on data governance.

- Advice: Get used to organizing financial documents digitally early on. Proper file management is crucial in accounting, and cloud-based solutions make it easier to collaborate securely with clients and colleagues.

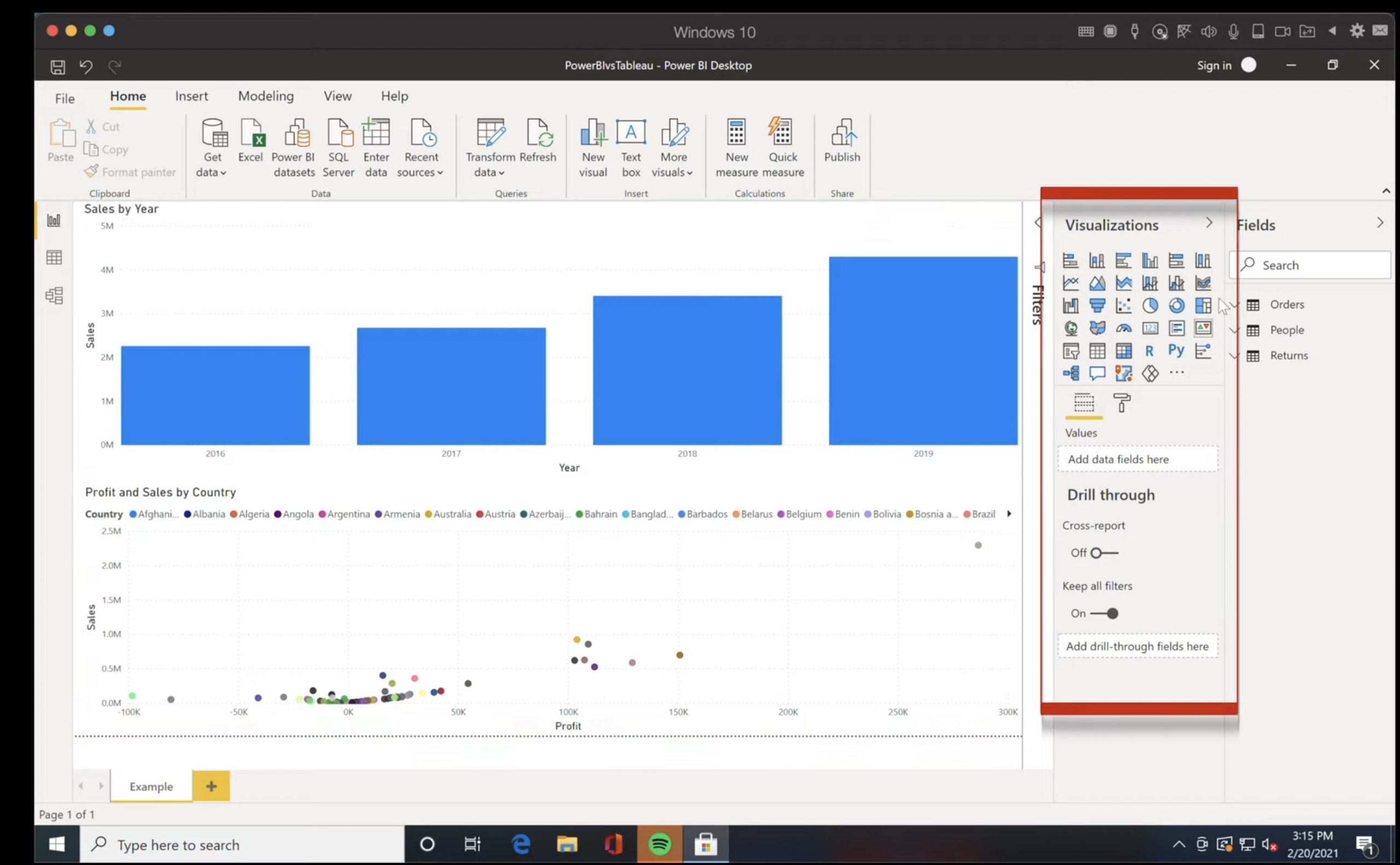

7. Data Analytics & Visualization Tools: Power BI & Tableau

- Usage: 5%

- How Often: These are fall into the more advanced and ocassional accounting tools. They are the ultimate tools to craete financial dashboards and reports which help you turn raw financial data into visual insights that are easy to understand and communicate to clients and stakeholders.

- When: Data analytics isn’t heavily emphasized in school so you’ll have to learn this entirely on your own.It isn’t a requirement to be a good accountant but if you want to stand out from the rest…you want to be able to give stunning visual representations that will WoW clients and make them more likely to keep you as their accountant.

- Real-World Example: If you have a client that seeks for financial insight on how well his business is doing and the possible scenarios for the future. You can create a dashboard that tracks key financial metrics while having a nice visual representation to show and use it to explain the business state and prospects to the client pointing out its financial health and areas for improvement.

- Learning Curve: Both Power BI and Tableau have moderate learning curves. You’ll need to understand the basics of data analysis, but there are many tutorials available to help you get started.

- Alternative Software:

- Google Data Studio: A free and easy-to-use tool for creating reports.

- QlikView: A more advanced tool for business intelligence and data visualization.

- Advice: Start learning data analytics tools like Power BI or Tableau. The ability to visualize and interpret financial data is becoming more and more popular today.

Conclusion

If you’re an aspiring accountant, my biggest advice is to get comfortable with the tools you’ll be using in the professional world. Accounting software, spreadsheets, payroll systems, and tax preparation tools are just the beginning. As the industry shifts towards data analytics and automation, the ability to work with advanced financial tools will make you more efficient and valuable in the workplace. Take the time to explore these options, practice using them, and continuously update your skills to stay competitive in the job market.

Author Profile

- I am physicist and electrical engineer. My knowledge in computer software and hardware stems for my years spent doing research in optics and photonics devices and running simulations through various programming languages. My goal was to work for the quantum computing research team at IBM but Im now working with Astrophysical Simulations through Python. Most of the science related posts are written by me, the rest have different authors but I edited the final versions to fit the site's format.

Latest entries

wowDecember 18, 20255 Best Laptops For World of Warcraft – Midnight & Classic (2026)

wowDecember 18, 20255 Best Laptops For World of Warcraft – Midnight & Classic (2026) LaptopsDecember 17, 2025The 4 Best Laptops For Virtualization of 2026 (10-50 VMs ATSM)

LaptopsDecember 17, 2025The 4 Best Laptops For Virtualization of 2026 (10-50 VMs ATSM) Hardware GuideDecember 17, 20252026 Beginner Guide to Reading Computer (Laptop) Specifications

Hardware GuideDecember 17, 20252026 Beginner Guide to Reading Computer (Laptop) Specifications LaptopsJune 30, 2025Best Laptops for Computer Science (July 2025 )

LaptopsJune 30, 2025Best Laptops for Computer Science (July 2025 )